01 Mar Investment Markets Update – March 2020

1st March 2020

Investment Markets Update

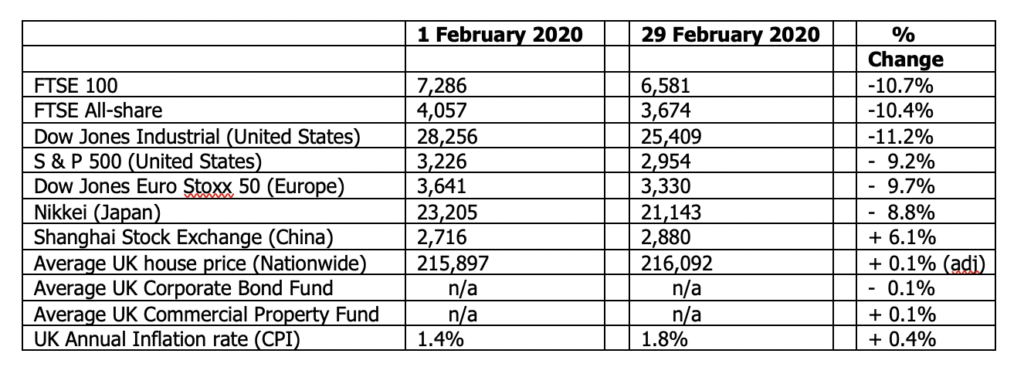

The figures:-

The reasons:-

In last month’s Update I reflected upon the calendar year of 2019 in terms of investment returns and the reasons behind those. It had been a very good year indeed.

However, when looking forward to 2020, I made the following comment: “out of a clear blue sky, a storm may always appear from nowhere. Suddenly China is hit with the Coronavirus and effectively closes its doors to the world. At this stage, it is impossible to know how much economic damage will be caused from this, with a lot of course depending upon the length of time and the seriousness of the outbreak as events unfold”.

Well, just one month on and the storm has truly broken across global stock markets. The final week of February saw the FTSE 100 and the US stock market endure their worst week since the financial crisis in September 2008. Readers will be fully aware of the background to the Coronavirus situation but the reason the stock markets have been falling so greatly is because there is panic in the markets that if people are unable to go about their daily lives, in many different countries and continents across the world, then there will be huge damage to the world economy and the very real prospect of businesses going bust. There currently remains the hope of a “V-Shaped” recovery; by this, it is meant that whilst there has been a strong economic downturn this year (the economic situation in China is truly dire) then if the Coronavirus situation is stabilised, there could be an equally strong and quick recovery as things return to normal, with pent up demand creating fresh business opportunities.

The risk, however, is that the Coronavirus becomes a global pandemic, causing the effective shutdown of many businesses and industries across the world for an extended period, during which time some of those business will go bust forever and a quick recovery would not be possible. Just as last month, it is still impossible to know how things will pan out but it seems to me that from the clear blue sky we were discussing just a month or two ago, a recession in many parts of the world, including the United Kingdom, is now a distinct possibility, even a likelihood.

Unless there is a sharp stabilisation of the situation in the very near future, I would expect policy makers and Governments across the world to start to take decisive economic action. Central Banks are likely to consider cutting interest rates. Look out for the Bank of England MPC Meeting on 26 March – my money is on a 0.25% interest rate cut. Loosening monetary policy further, such as quantitative easing, could be applied again. New ideas, previously untried, may be applied. This is the severest test to date of the globalised economy we now live in; successful UK businesses are in imminent danger of running out of supplies as the ships from China suddenly no longer bring in goods that they need to refine and sell on.

So how should investors react to this sudden, sharp deterioration in markets and sentiment? As ever, I would remind readers that investments are for medium-longer term purposes and volatility is inevitable, and sometimes unpleasant levels of volatility occur. It feels difficult to justify selling out of investments that have just fallen by, say, 10% in a week or two and I do not think that is probably the best solution here, even if there is still further possibility (probability?) of markets falling yet further still for now.

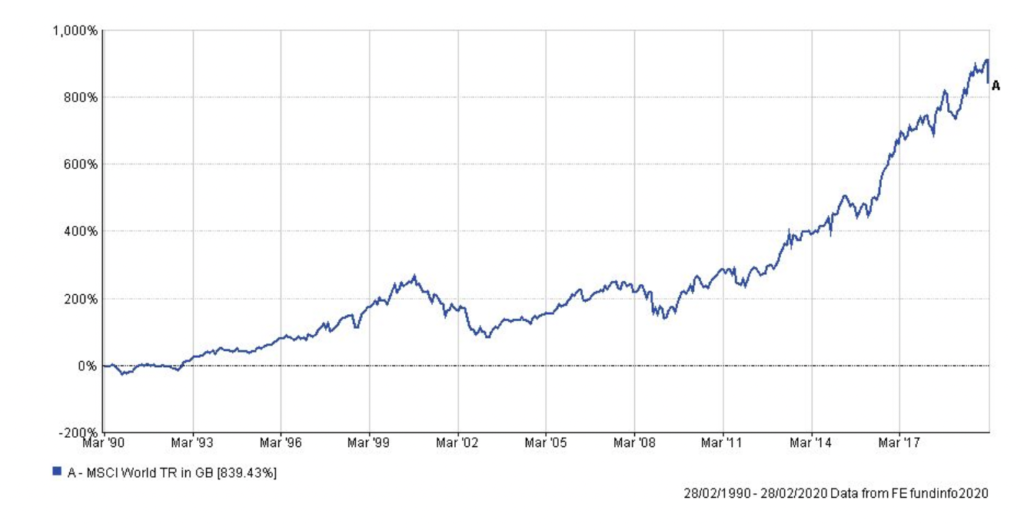

Things could very well get worse before they get better. I have therefore shown an historical chart to try to put things into perspective:

This is the world stock market index over the last 30 years. You can see the recent sell-off at the top-right hand corner of the graph. Remember, inflation affects everything, including share prices, so the dips in earlier years were actually far greater in real terms than they appear on the graph now.

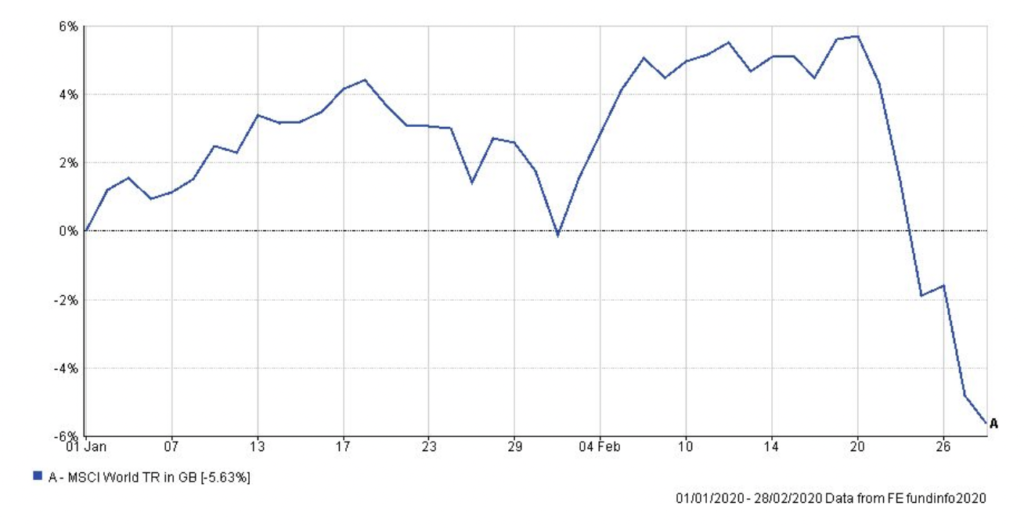

This graph is of the same World Share index – but over the last 2 months. A fall of over 10% from peak-to-trough in the last fortnight, but just one of many dips in the last 30 years:

The latest events again remind us of the purpose and benefit of a Diversified Investment Portfolio. As we have discussed on numerous occasions, the mainstream asset classes are Equities, Bonds, Cash, Property, Commodities and perhaps some alternative investments. The main two assets classes in a portfolio are usually Equities and Bonds. Bonds, which are loans either to Corporations or Governments, have been resilient over the last couple of months and in a “risk-off” environment (to use the jargon), are a very attractive asset to be holding.

So, for investors who are currently building up their funds, and perhaps making regular or one-off payments into their investment or pension plans, the current fall in markets prices can be seen as an investment opportunity. As and when markets pick up, the benefit of buying in at a price that has recently fallen very sharply is the potentially higher growth that will be seen in the future.

For investors who are holding their funds for longer term security then probably the best thing to do is to sit tight, close your eyes and wait for the storm to pass. I again refer to the graphs above and, in time, no doubt the current falls will appear as just another dip on the top graph.

For investors who are living on the income or regular withdrawals from their portfolio, care should be taken. Identify your income needs and aim to target areas of the portfolio that have not suffered from recent stock market falls e.g. Bonds and Cash. Try to avoid crystallising equity falls by not selling out immediately after a 10% drop. Give those assets time to recover. When, in time, Equities do no doubt recover then there is the opportunity to review the portfolio and perhaps “re-balance” the asset mix, if the withdrawals of Bonds and Cash has resulted in a rather higher proportion of the portfolio still left in Equities than would be the case for your attitude to risk and circumstances.

As ever, our Investors can contact us to discuss their own portfolio and circumstances in detail.

I have been in Financial and Investments Services for over 30 years. In that time, I have seen at least a dozen very sharp Stock Market falls, probably nearer 15-16. They are always disappointing, dispiriting and worrying, not least because one can never tell when the recovery will come about. But, so long as investors hold tight, don’t panic and target any required income carefully, then some advice that a colleague sitting at his desk next to mine gave to a client following the Black Monday stock market crash of October 1987 (when the FTSE fell by over 20% in just two days) will still hold true: As he explained to his panicking client, “you’ve not lost money, you’ve just lost time!”

Perhaps advice that is well worth remembering some 32 years later.

Please note these are the views of Christopher Charles Financial Services Ltd, and are for background information only. They do not constitute advice, nor should action be taken without specific advice, pertaining to individual circumstances. Investments can fall as well as rise in value, and you may not get back as much as you invested, particularly in the short term. E & O E – figures are produced with great care, but no liability whatsoever can be accepted for any errors of information within this document. Past performance is not a guide to the future. Christopher Charles Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

CCFS Ltd, The Dolls House, Teeton Road, Guilsborough, Northampton, NN6 8RB Phone: 01604 740022