01 Feb Investment Markets Update – February 2020

1st February 2020

Investment Markets Update

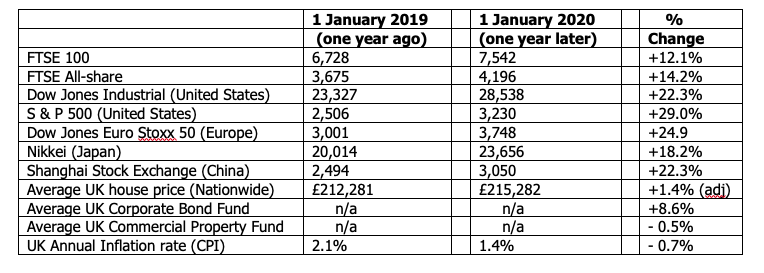

The figures:-

The reasons:-

After a difficult year for investments in 2018, 2019 turned out to be a complete turnaround, with markets moving sharply upwards. If a portfolio lost money last year, then there are some serious questions to be asked. Both Equity and Bond markets proved very kind, with particularly high returns seen in US Equities.

European and Chinese stock markets also returned over 20% with Japanese shares not far behind. The relative laggard, so far as the developed world is concerned, was here in the UK but even there double digit gains were seen in the stock markets.

Furthermore, UK Bonds also had a very good year, reflecting the falling inflation rate seen during 2019. The only fly-in-the-ointment was in the Commercial property sector (and to a lesser extent the UK housing market). Changing shopping patterns and the uncertainty over Brexit in 2019 held up many commercial property transactions. Sentiment in this asset type was poor, culminating in the temporary suspension of the trading in the M&G Commercial Property fund.

Cash continues to produce very low interest and still failing to match even the very low rates of inflation currently seen.

So, why did this all happen? Why were so few people expecting such a good year twelve months ago? Why was there such market pessimism in the last Quarter of 2018 and what changed? Of course, if we could really predict these things so precisely, then in theory there would be no markets, and the world would be a very strange place indeed. What happened was several significant turnarounds in economic policy that changed the dynamics of the “real world” economy and, as a result, stock market results.

Specifically, the US Federal Reserve made a complete U-turn on its interest rate policy. Having ratcheted up interest rates several times in 2018 and indicating there would be much further to go, it then took fright that they were driving the US economy dangerously close to recession. Suddenly, several reductions in interest rates were taken, loosening finance for business and individuals and giving a boost to the American economy. Stock markets rose accordingly, with particular gains in the technology sector and specifically the FAANG companies (Facebook, Amazon, Apple, Netflix, Google). These gains were particularly impressive when considering that the US$ maintained its strength in the currency markets. Furthermore, despite the interest rate cuts, inflation remains well under control. An almost perfect scenario!

The American economy still has a massive impact upon the world as a whole, despite the new noisy neighbours across in China increasingly influencing world events also. And it was this combination that led to a further improvement in market sentiment. After several years of on-off relations between President Trump and the Chinese Authorities, the “stage 1” Trade Agreement was reached in the latter half of 2019. As the name suggests, this is only the first step in a, hopefully, wider Trade Agreement but it was sufficient to give the markets optimism that the increasingly protectionist talk, across the globe, may not be fulfilled in such an aggressive manner as has been feared. Chinese economic growth continues to slow slightly each year but is still achieving more than 6% per annum – figures that the developed world could only imagine (There is, it must be said, always some uncertainty over the reliability of some of the figures from the Chinese Authorities).

As mentioned, despite economic stagnation and an industrial recession within Germany, European markets also gained well over 20%. Japan nearly matched Europe, despite the countries’ sensitivity to global trade and a VAT tax hike on 1 October.

Even here in the UK, with the Parliament caught in paralysis throughout the year, the FTSE 100 made a double-digit return, benefiting for most of the year from a weak pound, which increases the international earnings of many large UK companies, in Sterling terms.

The lack of inflation throughout the developed world and the reduction of interest rates in the US (leading to speculation that the UK may follow suit also) buoyed Corporate Bonds. Very often, Bonds and Equities are counter-cyclical; when one does well the other asset often struggles. Not so in 2019! Everything was on the up and up!

So, with 2019 now already wrapped up and the figures safely recorded – our typical Moderate risk portfolio producing around 15% last year, thoughts obviously move on the prospects of 2020.

Out of a clear blue sky, a storm may always appear from nowhere. Suddenly China is hit with the Coronavirus and effectively closes its doors to the world. At this stage, it is impossible to know how much economic damage will be caused from this, with a lot of course depending upon the length of time and the seriousness of the outbreak as events unfold. It certainly caused the Chinese stock market to close for over a week and, upon opening, record a very sharp 8% fall in values. Nevertheless, January saw stock markets hold relatively firm in most of the rest of the world, with US stocks again moving towards record highs.

UK shares look relatively cheap nowadays, particularly on my favoured indicator, the Price/Earnings ratio. If business benefits from the slowly clearing political uncertainty of the last few years then there is very good potential for share price increases in the next couple of years or so.

Should the economy still be slow during the first part of 2020, I would not be surprised to see the Bank of England trim interest rates a little further, which could give yet a further boost to Bond prices.

Again, as the dust starts to settle on the political uncertainty here in the UK, there is an argument for saying that the Commercial Property sector may find its feet again with more solid prospects going forward.

That all said, very few people predicted the stellar returns of 2019 when we were sitting here a year ago and I’m afraid that I’m still yet to find anybody holding an infallible crystal ball. We shall continue to watch markets with interest and diligence.

Please note these are the views of Christopher Charles Financial Services Ltd, and are for background information only. They do not constitute advice, nor should action be taken without specific advice, pertaining to individual circumstances. Investments can fall as well as rise in value, and you may not get back as much as you invested, particularly in the short term. E & O E – figures are produced with great care, but no liability whatsoever can be accepted for any errors of information within this document. Past performance is not a guide to the future. Christopher Charles Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

CCFS Ltd, The Dolls House, Teeton Road, Guilsborough, Northampton, NN6 8RB Phone: 01604 740022