01 Dec Investment Markets Update – December 2022

1st December 2022

Investment Markets Update

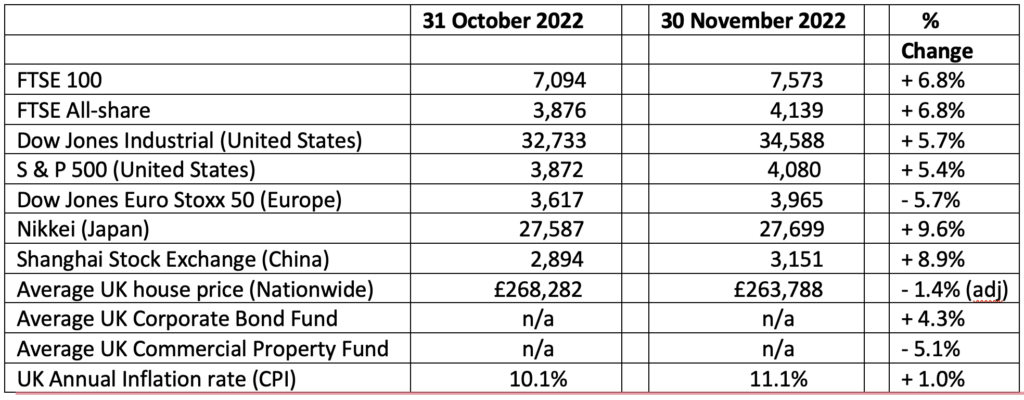

The figures:-

The reasons:-

After a few miserable months, both in the Stocks and Bonds markets around the world, we saw in November a significant rise in prices across both main assets. Why was this? Well, to paraphrase Bill Clinton’s political adviser in 1992, “it’s inflation, stupid”.

I have been asked many times during this year why stock markets have fallen and why Corporate (and government) Bonds – usually less volatile assets – have also fallen so heavily. I have had to explain that the root cause of all these problems has been inflation. It was already taking off at the start of the year, as the world moved out of pandemic restrictions, and the position was made significantly worse with the Russian invasion of Ukraine in February, which immediately fed through to significantly rising energy prices. However the signs are that, at last, the Western world’s inflation problems have probably now peaked and markets are sensing that the long-awaited fall in inflation rates is now commencing.

In the United States, inflation fell quite sharply last month, raising hopes that the aggressive interest rate rises that the Federal Reserve has been pursuing will now soften and indeed maybe come to an end by the Spring. The Eurozone area also saw its first inflation rate falls, although it is still above 10%. Here in the UK ,inflation reached a 41 year high of 11.1%. However, the expectation is that the pattern of inflation here will follow that of Continental Europe and the US and will also start falling from now on.

These welcome falls in inflation rates will not alleviate the short-term problems of many people having to contend with higher energy costs and wage rises lower than inflation has been this year. However, markets are more forward-looking (and unemotional) than that and they are looking six months ahead and seeing interest rates peaking by then. As I have explained previously, interest rates rises are disliked by Stock markets, because they impinge on business growth – as borrowing costs are higher – and they are detested by Bond markets because if newly-issued Bonds are offering higher interest rates than existing ones, then the price of the Bonds already in circulation has to fall.

So as you can see from the table above, Shares and Bonds throughout the world had an extremely good November on the improved outlook for inflation. Frankly, it was needed.

There is further potential good news (you wait all year for some and then two pieces come along all at once). The Chinese Government appears (so far as one can tell in these things) to have softened their views on their Zero Covid policy. The interminable number of lockdowns throughout the country appears to be a policy now put away for good. The Chinese economy has suffered significantly from these continued lockdowns throughout the year and readers will be fully aware of just how much growth China has created for the developed world’s economies over the last decade or so. With this great engine having been turned down so significantly over the last year or two, it has been extremely difficult for the Western world to grow their economies much at all and so this return to some form of normality in the Chinese economy is being welcomed by Stock markets throughout the world.

I think I should also comment on one of the other bits of data in the table above. For the second month running, the Nationwide has announced that house prices have fallen. I think this is going to be a trend for a little while now, not least because the higher interest rates that have been brought in this year have increased the cost of mortgage borrowing to new purchasers who need a mortgage to buy their property. Inevitably, this has meant that they have reduced the amount they’re able to afford to buy a house with and the market has noticeably cooled. I am not going to make any predictions as how house prices will do over the next year or so ( I will leave that to the experts to get wrong) but I do note that wage increases in the private sector (that which have been running around 6%) will give some buoyancy to the market, because although that figure is less than inflation, it does create a nominal increase in people’s pockets and so the affordability of housing is somewhat strengthened, despite the rise in interest rates. My suspicion is that some of the highest predictions of falling house values may turn out to be exaggerated. But falling house values can make people feel poorer, even those without mortgages, and can affect the “feel-good factor” that so much of our economy depends on these days.

One thing that is for sure though is that we’re not yet out of the woods. The spate of interest rate rises this year, across the US, UK and Europe is at risk of bringing in a recession as a price to pay for squeezing inflation out of the system again. The United States – with its greater self-sufficiency on energy sources – will be less affected than European countries, so is likely to see an economic recovery a bit earlier. For us in the UK, and across Europe, the race remains well and truly on to build new energy supplies (some of which takes years) and in the meantime there’s a struggle going on in central banks to balance interest rate rises – which slow the economy – with the need to not yet go soft on the fight against inflation.

I feel however that in the absence of further significant bad news (such as escalation of war in Ukraine), then we might be reaching the end of the worst of this investment cycle. The economy will likely run slowly for some time, but forward-looking markets may take a more optimistic view.

Thank you for all the questions, queries, challenges, and thoughts provided during a very difficult 2022. We shall continue to report back in 2023, but in the meantime, may I wish all our readers a happy and peaceful Christmas and, hopefully, a prosperous New Year.

Please note these are the views of Christopher Charles Financial Services Ltd, and are for background information only. They do not constitute advice, nor should action be taken without specific advice, pertaining to individual circumstances. Investments can fall as well as rise in value, and you may not get back as much as you invested, particularly in the short term. E & O E – figures are produced with great care, but no liability whatsoever can be accepted for any errors of information within this document. Past performance is not a guide to the future. Christopher Charles Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

CCFS Ltd, The Dolls House, Teeton Road, Guilsborough, Northampton, NN6 8RB Phone: 01604 740022