04 May Investment Markets Update – April 2020

1st April 2020

Investment Markets Update

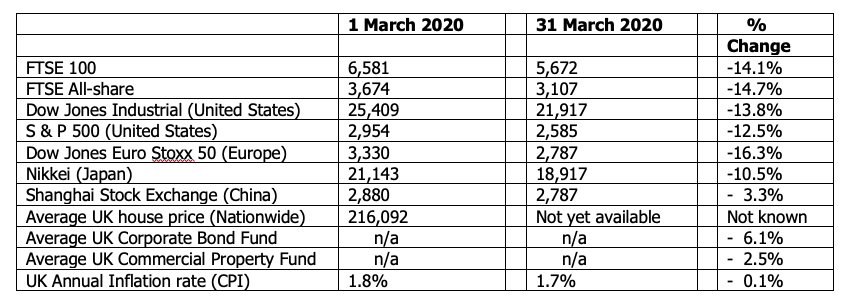

The figures:-

The reasons:-

Well, That Was The Longest Month In History. As you can see from the figures above, the stock market movements in March were completely dire. Indeed, if it were not for the slight recovery towards the end of the month, the numbers would have been even worse. The UK stock market, which has been particularly badly affected, had its worst Quarterly returns (down almost 25%) since the fourth Quarter of 1987, which, some older readers may remember, included Black Monday.

The reason for the enormous shock to the system was, of course, the sudden sweeping-out of the Coronavirus across the world, outside of China and the subsequent decision of many Governments to close down significant parts of their economies in order to isolate the general population from each other.

Never before have we seen such tactics deployed across the whole world and indeed never before have we seen such a curtailment of freedoms within the UK as were announced by the Government on March 20th and March 23rd. Even in wartime, the Government never closed the pubs.

So, how long will markets fall for and when might they recover? As I have said, there was some strengthening in world stock markets in the last week or so of March, mainly as a response to significant interventions from Central Banks and Governments of major economies. Here in the UK we saw an unprecedented level of Government support and intervention for the economy. The Government has effectively put the economy into an induced coma and plans on feeding it and keeping it breathing until the government feels it is safe to bring the economic patient back into consciousness. It is not clear how long this may take and, in the meantime, many millions of employees and self-employed people affected by the mandatory shutdown of so many business are being paid most of their wages by the State. This is not just Keynesianism. This is Keynesianism On Steroids Super Plus Plus. And coming, as it does, from a Conservative Government (traditionally wanting to think of itself as of “sound money”/”balancing the books” etc.) has there ever been a more extraordinary set of emergency measures put in place in this country?

Not only do we now have interest rates cut from 0.75% down to 0.10%, their lowest level in history (my prediction in last months’ Newsletter of an impending 0.25% cut by the Bank of England now looks naïve in the extreme), we now even have HMRC operating, not as a tax collector, but as a Benefits Office, giving money back to people, not the other way around!

So, we know the markets are in turmoil and panic. A recession in the UK and around the world is a nailed on certainty – we are already in it, it’s just that the figures are produced quarterly in arrears. When might we see some sense of market calm and even recovery? The things to look for are signs that governments around the world are prepared to “do whatever it takes” (in the phrase that former European Central Bank chief Mario Draghi once used, and single-handily quelled the eurozone crises in 2012) to ensure that businesses don’t go bust (and thus lose all shareholder value and which would also slow down a future recovery) during this period of “induced economic coma” that they have put us all into. The markets are desperate to be reassured about that and the huge bazookas the Federal Reserve in America and the Bank of England fired here were what helped prop up markets from their lowest points in Mid-March. The European Central Bank’s effort was more of a damp squib than a bazooka, but some national governments in Europe have since started their own support strategies. I suspect the ECB will get its act together as well in the end.

Secondly, the markets want to see people returning back to work and earning/spending money again. If you look at the table above, it’s noticeable how China’s stock market fared so much better this month than other developed economies – they went into the virus first but appear to be coming out of it first too. People are now having their restrictions lifted, and resuming work. Factories are reopening again. That’s what markets want to see.

But significant risks remain. We are told in Europe and America that things will get worse before they get better. The strains on a comatose economy can only increase, and America – the worlds’ largest economy – and with its unpredictable president – looks at greatest risk. Governments may be required to fire further bazookas into the economy (all of which will have to be paid for, one day) and there’s always the risk of an outbreak of the virus re-occurring. My thanks (sort of!) to our client who recently pointed out to me that in 1918-19, it was the second wave of Spanish Flu, six months after the first, that killed the most people. Markets will be watching China anxiously and if there’s signs that Coronavirus is re-infecting the population to any significant amount again, there will inevitably be further falls.

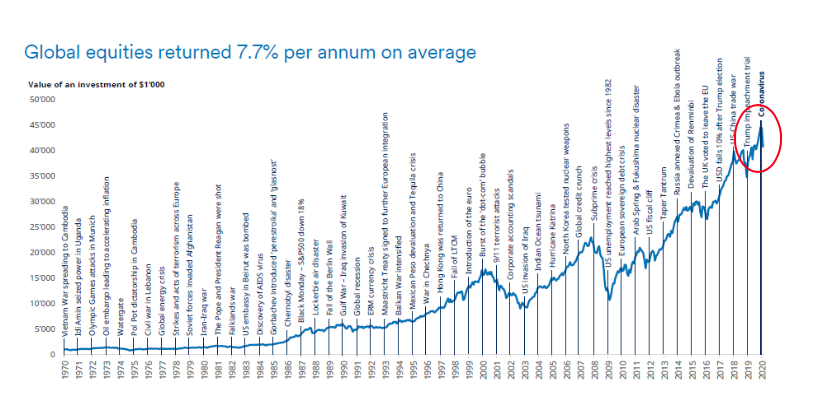

I think, therefore, it is sensible to try to put this extraordinary situation into some kind of perspective. Without trying to underplay the crises at all, we are told by medical experts around the world that we can and will overcome this virus. Life will return to normal, bit by bit, in the months ahead. When markets can see that in front of them, they may recover, possibly strongly. So, here’s a graph of world stock markets over the last 50 years (source : Cazenove Capital) showing how the average return from global stock markets has been 7.7% per year on average, better than Bonds, Cash or property. But, in return for those profits, there are risks and short-term volatility, as you can see.

Obviously, a 50 year timescale is too long for almost all investors but you can see how the current fall has compared to the long term growth of stock markets. It’s important to remember the purpose and benefits of long-term investment, and not be overly distressed by short-term difficulties, however hard they may seem for a while.

So, my points to takeaway at this stage would be:

- We are – in the West at least – still at the early stages of the pandemic. Things will get worse before they get better, both medically and economically.

- Governents and central banks have shown themselves to be both brave and imaginative so far, in coming up with ideas to keep some kind of functioning economy whilst isolating people for health reasons.

- Stock prices are being hammered by the fear/reality of falling profits. Cuts to company dividends (of which there will be plenty) will push down share valuations further.

- We have moved into recession already – future data will prove it. The hope is that a mixture of medical science and aggressive economic stimulous by governments will allow for a quick and strong recovery when the pandemic is brought under control. That remains a reasonable hope, though there’s still considerable uncertainty.

- Ultra-low interest rates seem set to stay for a further period.

- Circumstances – and stock markets – will pick up again eventually. Look at the graph again and see why.

- Remember the benefits of long-term investment, and don’t panic at even very difficult short term periods. But remember the benefits of a diversified portfolio. Non-equity assets provide ballast and support when shares are in freefall. Longer periods of relative underperformance of Bonds and other assets compared to equities are quickly forgiven in these circumstances.

Please note these are the views of Christopher Charles Financial Services Ltd, and are for background information only. They do not constitute advice, nor should action be taken without specific advice, pertaining to individual circumstances. Investments can fall as well as rise in value, and you may not get back as much as you invested, particularly in the short term. E & O E – figures are produced with great care, but no liability whatsoever can be accepted for any errors of information within this document. Past performance is not a guide to the future. Christopher Charles Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

CCFS Ltd, The Dolls House, Teeton Road, Guilsborough, Northampton, NN6 8RB Phone: 01604 740022