24 Dec Investment Markets Update – 2022 as a whole year

2022

Investment Markets Update

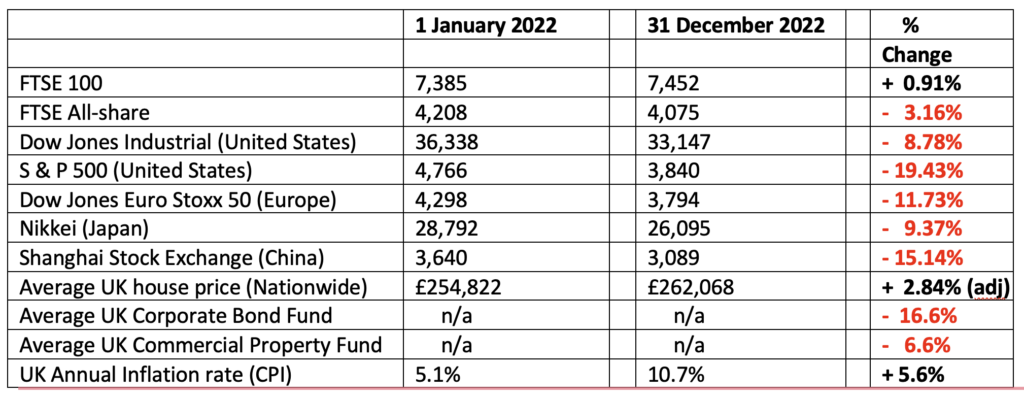

The figures:-

The reasons:-

As we do each January, I have shown above the usual table of market figures, but based upon the full year just gone, not just the month. I also looked back at my own comments from the January 2022 newsletter, when reporting back on what had been a successful year for investors. Two comments from back then now look somewhat prophetic:

“Needless to say, however, there are always risks and concerns going forwards and I think the two to highlight at this point would be inflation and the risk of Russian invasion into Ukraine…. It is also true to say that stock markets will hate the uncertainty and there is a risk that some of those gains made last year could be handed back in the short term at least”.

Too prophetic, as it turned out. Russia did indeed invade Ukraine on 24th February. At that point inflation in the UK was already on an upward trajectory. Equally, the Bank of England had moved sooner than other major Central Banks and had started raising interest rates from December, just before Christmas. However, the Russian invasion led immediately to a spike in gas and other energy prices, causing significant inflation throughout the rest of 2022 and, as a result, ensuring that the Bank of England increased UK base rates on every one of the eight meetings of the Monetary Policy Committee in 2022, taking the base rate from a starting point of 0.1% in November 2021 up to 3.5% by December 2022.

The effects of this were to make UK Stock markets (other than the FTSE 100) fall – significantly. The FTSE 250 (which is not on the table above) fell by 20% during 2022. The S&P 500 which covers the largest 500 companies in the United States, fell by a similar amount.

In general terms, bigger companies, that pay decent Dividends fared less badly than medium size or smaller companies.

The standout stock market in the developed world was our own UK FTSE 100. In addition to benefiting from 100 very large companies that in general pay good Dividends, the FTSE 100 also happens to be dominated by many energy and chemical companies that did extremely well as a result of the energy crisis. As we have discussed before, the media tend to report the FTSE 100 as the bellwether for UK stocks in general, despite it being chock-full of global companies that just happen to be listed in London (although I do note that the more UK-centric FTSE 250 is now being quoted by the media on a more regular basis. Indeed, I think we will change this newsletter to show the FTSE 250 returns rather that the FTSE All-Share for future additions).

As a result of this media focus on the FTSE 100 and its unusually strong relative performance in 2022, many investors may have been rather unaware of just how poorly stock markets throughout the world in general performed in 2022. In the technical jargon, it was a stinker of a year.

Furthermore, Bond markets also suffered. Higher interest rates – brought in because of the higher inflation – meant that existing bonds in the marketplace became less valuable, as new issues were offering a higher rate of interest than the existing stock. In order for those existing bonds to be saleable, the price had to fall accordingly.

Commercial property was, for the first half of the year, surprisingly resilient as it continued a post-covid recovery. However, it has also succumbed to the general despondency of the markets in the latter half of the year, and we saw a fall in that sector also.

Much of the blame for the miserable market conditions in 2022 could therefore fairly be demonstrated as a Western economic phenomenon and even most of the world in general. However, our own politicians then added their own input to make things even more difficult. The short-lived Liz Truss Premiership saw some very strong messages, plans and tax cuts announced. However, with the Government failing to explain how all this would be paid for, the markets essentially dumped the UK. UK Shares fell further than they had already, but Bonds – including Government Bonds – fell even harder. Bond prices went down, and their yields (interest rates) went up accordingly. This had an immediate effect on mortgage rates and the Government suffered significant political fallout, from which it continues to try to recover today, under new leadership.

Looking Forward – And with some optimism

So, having reappraised the miserable year for investors just completed, what next?

I am one of those in the more optimistic camp. I believe that – with the caveat that the Ukraine war does not take a significant and more dangerous turn – we may be just about through the worst. UK inflation fell for the first-time last month, albeit modestly. Due partly to the mathematics of inflation calculation, it seems highly likely that those figures will fall much further during 2023. Inflation in Europe and in the United States also appears to have peaked. Although Central Banks are highly unlikely to rest on their laurels at this stage, I do feel that the number of interest rate increases to come is going to be limited and in ever decreasing sizes. As we have discussed before, the Central Banks are walking a tightrope between getting inflation back under control again and trying to avoid placing their respective countries into an unnecessary recession.

It may be the UK is already in or close to recession (future figures will confirm or deny this) but the general agreed outlook is 2023 will see a low levels growth in the UK economy, if any at all. However, stock markets do look forward 6-12 months. Although there is plenty of negative data around if you want to look for it, there are also indicators showing quite a resilient economy here in the UK, and even more so in the United States. Unemployment levels remain low. Private sector earnings are relatively high (albeit lower than the peak inflation we have seen in the latter half of 2022). If interest rates do stop rising in the next few months, then you can anticipate a recovery in the Bond markets. Indeed, this has already started to happen with the Sterling Corporate Bond sector gaining 7% over the last 3 months (note: it was still down 16.6% in the year overall, even with that significant year-end rally). I think there is virtually nil chance of interest rates going as back to as low as they have been for the last few years but if inflation continues to fall and the UK economy falls into recession, there will now be scope for some interest rate cuts later in 2023, if the Bank of England feels confident enough in its inflation policy, to do so.

The European Central Bank started later in raising interest rates (they even had negative interest rates for the last few years) but are now making rapid increases to push down on inflation in the first half of 2023. Whilst the timing might be a little different from the UK market, the circumstances are not dissimilar, and I feel that European Equities and Bonds are likely to behave in a fairly similar manner as here in the UK.

Looking further overseas, the Indian economy continues to grow and has leapfrogged above the UK (once again) to be the 5th largest economy in the World. Currency movements do sometimes lead to the UK regaining that position from time to time, but I think we are close to the point where we will simply not be able to catch up again due to the size of the population of India, even if the GDP per capita there remains significantly lower than ours. The Indian markets have been performing relatively well in recent years, unlike those in China which have suffered the covid pandemic and in particular the zero-covid policy introduced and continued right up to recent weeks. Although this has now been abandoned, we are seeing significant covid infections (so far as we are able to ascertain, given the opaque nature of Chinese government statistics) and so it is likely that the Chinese economy will not yet be fully getting back to its position of being the engine of growth that it has been for the last 20 years. Indeed, 2022 was the first time in 30 years that the Chinese economy has grown more slowly than the east Asian economy as a whole.

As a result of all this, and the turn of political sentiment in the West somewhat against China for a variety of reasons, it appears likely now that the Chinese economy will not overtake the US economy in terms of overall size until the next decade. Until recently, many commentators have been predicting the changing of the guard of the world’s largest economy to be later in the 2020’s but this now appears to be improbable. That all said, however, the re-emergence of China from its self-induced Covid slumber will re-charge economic activity there and will create a tailwind for the rest of the world, that has been missing for some time.

And so, the end of a difficult year for investors and the start, hopefully, of a better one. I have received many emails and phone calls during last year about falling investment values and I’ve tried to explain the reasons for them. It is very difficult to time the ups and downs of investment markets and the best defence against volatility remains a diversified portfolio of Bonds, Equities, Cash and other asset groups plus the ability to hold the investments for a number of years (e.g. five years or more) to allow for the inevitable ups and downs which are the hallmark of any investments. The trick is when things are falling, to grit your teeth and hold your nerve and wait for the recovery. Unless capitalism has come to an end (it probably hasn’t) or there is some significant long-term disaster to hit the world (hopefully not), then the recovery will inevitably happen. Fingers crossed we see that starting in 2023.

Please note these are the views of Christopher Charles Financial Services Ltd, and are for background information only. They do not constitute advice, nor should action be taken without specific advice, pertaining to individual circumstances. Investments can fall as well as rise in value, and you may not get back as much as you invested, particularly in the short term. E & O E – figures are produced with great care, but no liability whatsoever can be accepted for any errors of information within this document. Past performance is not a guide to the future. Christopher Charles Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

CCFS Ltd, The Dolls House, Teeton Road, Guilsborough, Northampton, NN6 8RB Phone: 01604 740022