30 Apr Investment Markets Update – 1st quarter 2024

30th April 2024

Investment Markets Update – 1st quarter, 2024

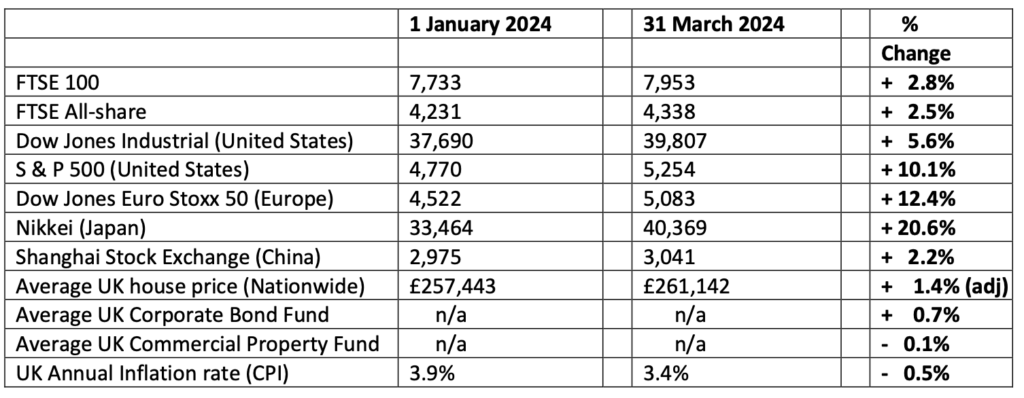

The figures:

The reasons

I am pleased to report a very positive set of figures for the 1st Quarter of 2024. Across the board we saw asset values rising, with particular gains in the United States and Continental Europe, whilst Japan showed some quite extraordinary gains. They must be partying like its 1989 on the streets of Tokyo today (party spoiler: the Japanese market then fell by 35% in 1990).

The UK markets were, relative to all this celebratory mood, somewhat muted, although gains were seen in the FTSE 100, 250 and All-Share indices as well. It should also be noted however that in March, by itself, the UK outperformed the world markets as a whole. One swallow does not a summer make, but this might – just might – be an indication that the unloved UK market may be back on the international radars again. There has been significant publicity of the loss to the FTSE 100 of major companies, as they choose to re-register on the New York market, where capital is more easily available and share price increases greater. But there is now – for the first time in several years – a net inflow of investments into the UK markets. This is not too surprising, as UK shares look seriously cheaper than their counterparts in Europe and – especially – US stock. Those hardest hit markets – UK Mid-Cap and smaller companies might well see a rebound in fortunes over the next year or so.

After a very strong finish in 2023 (typically up by 10% in value within the last two months), Bond investments also made further slight gains in the 1st Quarter of 2024, although I feel this market is still ready for another strong uptick.

So why have we seen such a significant improvement in Equity and Bond markets over the last few months? Well, as I have continuously explained since the beginning of 2022, it’s all been about interest rates and inflation. With the invasion of Ukraine in February 2022, we saw food and other material prices rise quite considerably. The response of Central Banks across the world was to raise interest rates significantly, in an effort to slow down the rate of inflation and bring it back down to their targets, typically around 2%. At one point inflation reached 11% here in the United Kingdom.

However, since autumn of last year, inflation has fallen back strongly across the western world. Interest rates have stopped going up and the markets have been eagerly anticipating when there may be cuts to follow. Bond markets became rather too over excited at the end of 2023, as they anticipated as many as five or six interest rate reductions in the United States and around four here in the United Kingdom. After the Christmas hangover came the realisation that this was probably somewhat optimistic on their behalf, and we saw rate cut expectations reduced somewhat (hence the rather more muted gains in Bonds thus far in 2024). Nevertheless, the Bank of England have been making generally (cautiously) positive noises about reducing interest rates later this year and the market continues to price in these anticipated falls, hence the stabilised values locking-in last year’s gains.

Fixed Interest (Bonds) detest higher interest rates because it makes the existing Bonds worth less (why buy a low-yielding Bond, when new issues offer higher rates? Only by discounting the price of existing Bonds can they be sold). Equity markets dislike higher interest rates because it increases the cost of borrowing to businesses and takes money out of the pockets of consumers who are unfortunate enough to be on variable rate mortgages.

Indeed, it has been well commented of how poorly targeted and one-clubbed the Bank of England have been in their efforts to control inflation. With the majority of homeowners not having a mortgage, and of those that do some 90% now being on fixed rate deals, the effect to the general consumer of raising interest rates is significantly dampened these days. Whilst many of us believe that the Bank of England left interest rates too low at 0.1% for too long, I would personally question what the point of the last three rate rises above 4.50% were, other than helping the UK to fall into a shallow recession at the end of 2023. As so often, we see Central Banks yawing too far one way and then back the other, rather than keeping a steady hand on the tiller. In any event, it appears very likely we shall see interest rate reductions during 2024, albeit probably later in the year than markets had previously hoped for due to inflation falling somewhat more slowly than previously anticipated. To lock in those recent gains in Bond asset prices, and not see them fizzle out again, we really would want to be seeing some action by Central Banks by the late summer, if not before. Stock and Bond markets will be becoming increasingly impatient to see that all-important first move, and current bets are that it shall be the European Central Bank (ECB) who will be in first, with a 0.25% cut in rates, in June.

As ever, there are risks on the downside too. The increasing level of warfare in the middle east risks a spike in oil prices, thus keeping inflation higher. US stock markets in particular look expensive – company earnings must stay high, and rising, to justify the price of their shares at present (by contrast, UK shares now look amongst the cheapest in the developed world). Economic growth throughout Europe, including the UK, remains anaemic. There will be many elections in the world in 2024, bringing with it new uncertainties. A new Labour government here at home looks a near-certainty, but the Labour party has gone to great lengths to reassure the City that it will not bring an anti-business agenda, and companies appear calm at the prospect of a new government, including Chanceller Reeves, for the time being at least. A second Trump presidency in the United States currently looks about 50/50, and if it happened, that would bring uncertainty and unpredictability – though markets did perfectly well during his first term. Readers may recall the then-President often claiming credit for when the markets went up, but it was always somebody else’s fault when they went down!

Overall, however, we currently appear to be over the worst, hence the general recovery in Stock and Bond markets since 1st November, but to move forward, we need to see those inflation figures fall further and then those all-important interest rate cuts and maybe, just maybe some genuine economic growth here in the United Kingdom.

Thought for the day – The problem with making market predictions

Notwithstanding my reasoned and (to my mind) logical thoughts as to how and why we shall see markets progress throughout the year, the reality is that making accurate predictions is very, very hard.

At the end of each year, “broadsheet” newspapers and other media are festooned with experts giving us their predictions of stock markets for the year ahead. Looking back at some of them later, you realise just how much they didn’t know, didn’t appreciate, or didn’t understand. More charitably, you realise that, just like everyone else, they don’t have prophetic powers. However as much as some of us like to think we understand and maybe are even experts in investment principles, taxation law, economic data etc, nobody can accurately predict the future. There are just too many “unknown unknowns”, as the then US Secretary for defence Donald Rumsfeld would say.

Look back to the start of 2020, and the bullish predictions then….nobody even thought to mention the small matter of Covid-19 that was being reported in China. Two years later, Ukraine was ignored at the start of the year – within 8 weeks, the Russians had invaded, and the western world’s economies upended.

So, I would argue that a key principle of investment is preparation not prediction. Thanks to 7IM Investments for pointing out that if Wall Street analysists, with all their know-how, experience and resources, can’t predict what will happen and when, it might be worth spending your time doing something else.

And so, I continue to think of investments in terms of diversified portfolios. We all want the ISA, the Pension fund or other investment portfolio to move from the bottom left of the graph to the top right. But mostly to do so in as stable a manner as possible. And that means selecting different asset types. Some that work best in certain environments and others in different situations. Some assets may be powering ahead whilst others appear to be standing still, or maybe even going backwards. But with the passage of time, unpredicted situations occur, and we see reversal of fortune for those previous laggard assets.

That doesn’t mean all investments will end up with the same gains over the longer term – some assets (predominately equities) should finish on top. But only with diversification can returns be somewhat controlled, and volatility reduced to levels acceptable to any particular investor.

Unless you are blessed with the gift of Nostradamus, then don’t put all your eggs in one basket. Donald Rumsfeld wouldn’t.

Please note these are the views of Christopher Charles Financial Services Ltd, and are for background information only. They do not constitute advice, nor should action be taken without specific advice, pertaining to individual circumstances.Investments can fall as well as rise in value, and you may not get back as much as you invested, particularly in the short term. E & O E – figures are produced with great care, but no liability whatsoever can be accepted for any errors of information within this document. Past performance is not a guide to the future. Christopher Charles Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

CCFS Ltd, The Dolls House, Teeton Road, Guilsborough, Northampton, NN6 8RB Phone: 01604 740022