01 Jul Investment Markets Update – 1st half 2023

1st July 2023

Investment Markets Update – 1st half, 2023

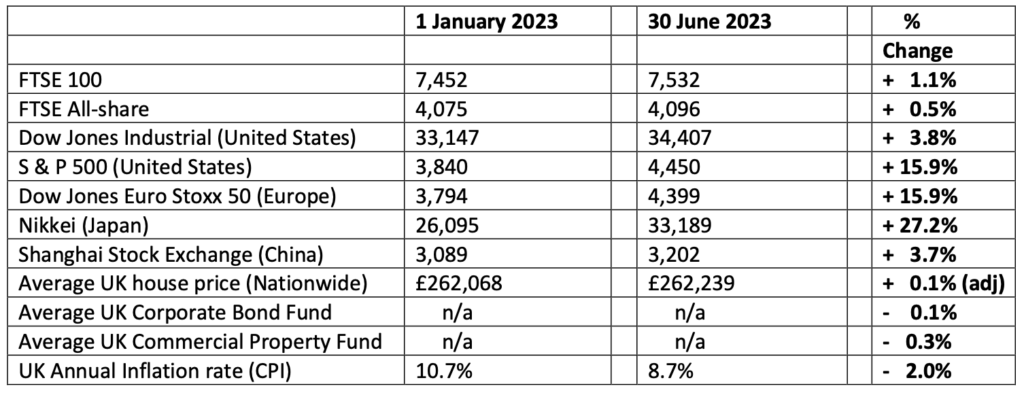

The figures:

The reasons

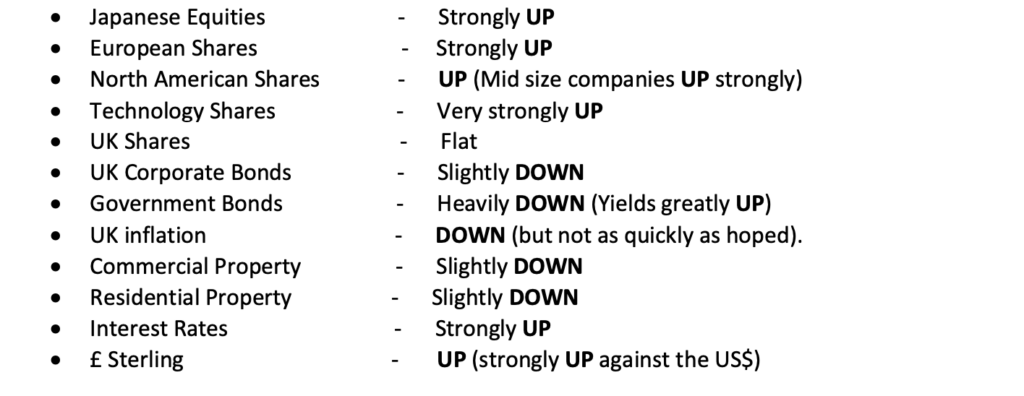

At the halfway stage of 2023, we can see how well (or not) various markets have recovered from the difficult year of 2022. The highlights are:-

So, a mixed bag from an investors point of view. After the FTSE 100 being a leading performer of 2022, it has thus far been a laggard against rival indices across the developed world so far this year. The FTSE All-share Index – the wider UK index – was also flat over the first 6 months.

In contrast, Japanese, European and North American shares rose strongly. This was generally good news for investors of course, but sadly, the effects to this for the UK investor – and certainly so far as US shares was concerned – was quite significantly dampened by the strong rise of the Pound Sterling in the first half of the year, especially against that Dollar.

The Pound, which some commentators had previously predicted would fall to parity with the US Dollar this year, moved the other way and jumped up to over $1.25 by the 30 June. This strong rise was brought about due to a combination of UK interest rates being ratcheted up aggressively by the Bank of England and also the avoidance (so far at least) of a recession in this country, which again many commentators had previously predicted would happen.

A strong pound does help to reduce inflation as import prices are reduced. But for investors, if an overseas market gains by 10% but the Pound gains by 10% against that overseas currency then the return to the UK investor ends up being pretty flat. For this reason, investors in this country have not seen the gains that might have been expected from investments in markets described above. Of course, Sterling does fluctuate and at times does assist the local investor whilst other times proving to be a headwind against returns.

Corporate Bonds, having suffered a very difficult year in 2022, have broadly flatlined. Longer duration Bonds (meaning those that mature well into the future) are more affected by interest rate rises seen over the last 18 months. Shorter duration Bonds which mature soon are less volatile, because of course they are due to pay out soon anyway. Again, we cannot really anticipate Government Bonds and Corporate Bonds bouncing back until inflation is properly under control and interest rates stop rising.

“Bricks and mortar” Commercial property funds were, for the first half of the year, surprisingly resilient. The continuing increases in interest rates and post-Covid business re-organisations do keep that sector at risk, however.

Investment recovery – Are we nearly there yet?

In 2021, we saw strong markets and good investment returns. In 2022, it was the opposite, and those gains were entirely reversed. The first half of 2023 has seen broadly flat returns. So, 21⁄2 years, and the typical diversified portfolio sits at around the same level as it started. It’s not been an inspiring period.

However, the reasons for all this are pretty clear – post-Covid inflation plus the war in Ukraine led to a very strong burst of inflation throughout Europe and the United States. Interest rates jumped strongly in response – depressing equity markets and hitting Bonds even harder.

However, there is light at the end of this tunnel, I believe. The United States has been leading the way in reducing inflation, and although the Federal Reserve may make one or two more interest rate increases, we might well be reaching the end of that interest rate cycle.

Continental Europe has also seen inflation start to fall strongly too, and will hopefully follow a similar trajectory. The United Kingdom has definitely been slower in seeing its inflation fall, but even here, we have been heading in the right direction. Key dates are 19 July, when the June inflation figures are announced at 7.00am, so remember to take your wireless with you into the shower. Also, 16 August, when the July figures are out – and that will include the new, lower, energy price cap effect. Until then, squeaky bum time for Andrew Bailey and his Monetary Policy Committee at the Bank of England.

Overall, however, the UK is part of the global economy and will, by and large, generally move along with the general trends seen overseas, so I expect inflation to come down quite a bit during the second half of this year, helped in part by the price rises of last year falling out of the rolling 12 month period.

Cash is King

One asset class that has benefitted from the inflationary period is Cash. Having been ignored by savers

and investors for over a decade, rates of 5%, or even 6% are available again – “risk free”.

As a result, we have increased our allocation of Cash within portfolios, especially for clients taking regular withdrawals for income purposes.

As you may have read in my previous email, we are using several Fixed Term Deposits that are available on our preferred platform. The highest rate at the time of writing this newsletter is 6.30% per annum for 3 years. There is, of course, the risk of selling stock (especially Bonds) now turns out to be the bottom of the market, and then having to watch those assets race past Cash holdings over the next year or two. However, for income needed in the next couple of years, these Cash rates look quite attractive again, particularly given the peace of mind offered by Cash, whilst the rest of the portfolio remaining in “real assets” is granted time to grow.

We have also had many clients move Cash accounts with Banks and Building Societies into these Fixed Term Deposit accounts. Feel free to speak with me if you have languishing Cash in old poor-interest bank accounts.

Please note these are the views of Christopher Charles Financial Services Ltd, and are for background information only. They do not constitute advice, nor should action be taken without specific advice, pertaining to individual circumstances.Investments can fall as well as rise in value, and you may not get back as much as you invested, particularly in the short term. E & O E – figures are produced with great care, but no liability whatsoever can be accepted for any errors of information within this document. Past performance is not a guide to the future. Christopher Charles Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

CCFS Ltd, The Dolls House, Teeton Road, Guilsborough, Northampton, NN6 8RB Phone: 01604 740022